While Canadians can now file their tax return, many don’t feel confident enough to do it themselves. In fact, a recent Intuit TurboTax study found that more than 8 in 10 Canadian adults say they didn’t learn how to file their taxes in school. For many, tax season comes with an onset of stress, balancing […]

High cost of living forcing younger workers to delay saving for retirement

A recent survey commissioned by Oaken Financial suggests that Canadian workers face a potential retirement funding shortfall with nearly half of respondents reporting that they either started late, or have not yet started saving for their retirement. Fifty per cent of workers aged 35 – 54 (generation X) fell into this category while 54 per […]

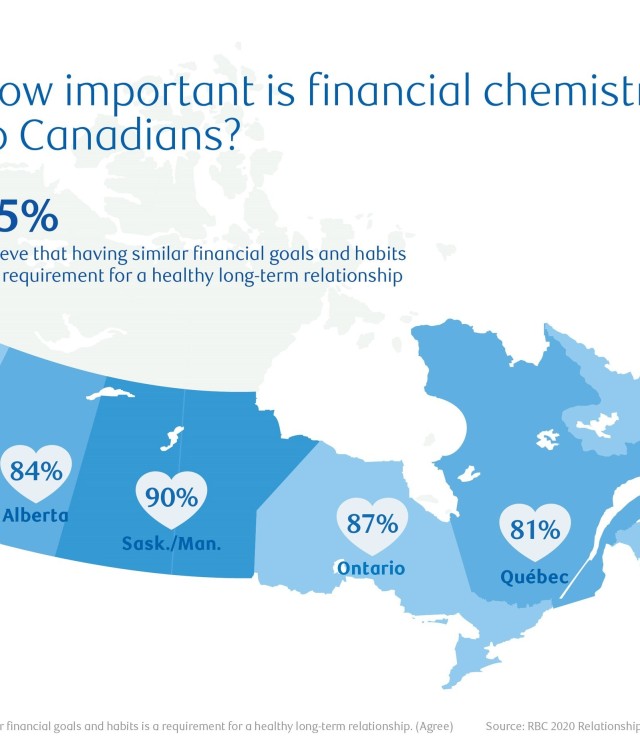

Two-thirds of Canadian couples link financial stability to relationship success: RBC poll

Successful long-term commitments rely on strong financial compatibility as well as romantic chemistry, according to the RBC 2020 Relationships & Money Insights Poll. The majority of Canadians with partners (85%) felt that having similar financial goals and habits was a prerequisite to their healthy, long-term relationships. Four-in-five (80%) believed it was important to speak with […]

Happy Valentine’s Day. No Gifts Required

Love. Who doesn’t love being in love? I love being in love. I love being loved. February 14 is Valentine’s Day. It is the day we celebrate romantic love. In the past, I thought of it as just another day to receive gifts from my significant other. This year I asked my true love not […]

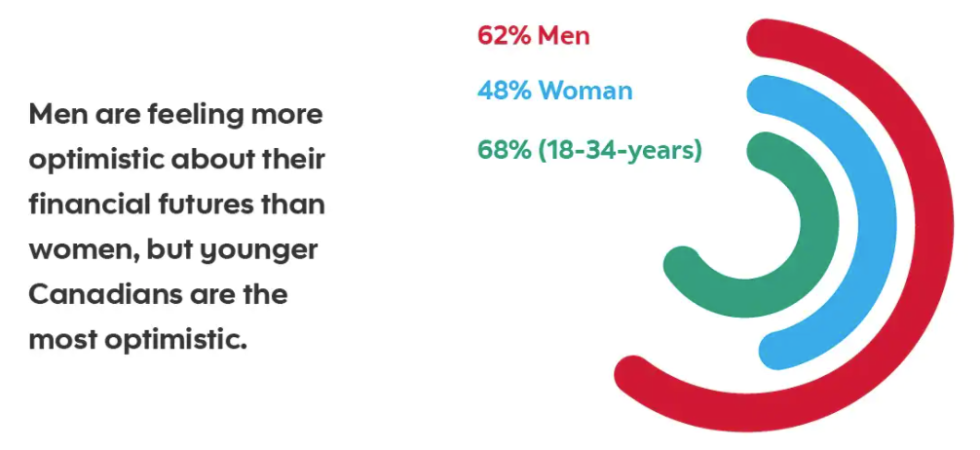

70% of Canadians Think They Won’t Save Enough for Retirement

A recent Scotiabank Retirement Survey revealed that while 68% of Canadians are currently saving for retirement, 70% are worried that they are not saving enough. According to the findings, the average Canadian expects to need $697,000 in retirement savings, less than the average amount of $753,000 expected back in 2017. Findings from the 2019 Scotiabank […]