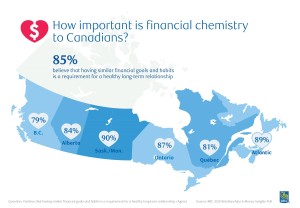

Successful long-term commitments rely on strong financial compatibility as well as romantic chemistry, according to the RBC 2020 Relationships & Money Insights Poll. The majority of Canadians with partners (85%) felt that having similar financial goals and habits was a prerequisite to their healthy, long-term relationships. Four-in-five (80%) believed it was important to speak with a prospective partner about finances before getting involved in a serious relationship.

Successful long-term commitments rely on strong financial compatibility as well as romantic chemistry, according to the RBC 2020 Relationships & Money Insights Poll. The majority of Canadians with partners (85%) felt that having similar financial goals and habits was a prerequisite to their healthy, long-term relationships. Four-in-five (80%) believed it was important to speak with a prospective partner about finances before getting involved in a serious relationship.

When it comes to fraternizing with your partner about your finances, it’s not just about what you say, but how often you say it, too. More than three-quarters (77%) of Canadians in relationships reported they speak with their partners about finances at least monthly, to create shared budgets (45%), come up with financial goals (41%) and save together (37%).

Here are tips from RBC to help Canadian couples stay on the same page and reach their financial and life goals together:

Find the budget that’s right for you: Discussing finances and setting clear financial goals and boundaries are important for any relationship. By coming up with a shared, realistic budget, Canadians can ensure they are on track with their partners, while leaving little room for surprises down the road. NOMI Budgets takes the thinking — and the manual calculation — out of setting up a budget for RBC clients. It focuses on five key categories and keeps the client on track by sending regular updates through the RBC Mobile app’s budget tracker.

Say “I do” to a shared financial plan: Creating a detailed financial plan and sharing this with your partner can help you work together to reach shared savings goals. Here’s where RBC Financial Planning can provide advice to help ensure money is there for you and your partner at various stages throughout your life together – for example, buying a car, getting a mortgage, raising a family and planning for retirement.

Invest for the future: Having a 20-minute conversation with a financial planner or advisor – in a bank branch or from the convenience of your home or office – can help you break the ice with your partner and begin talking about your shared financial goals. RBC’s MyAdvisor is an online financial advice service that connects you wherever you are with RBC financial planners and advisors who can give you guidance about how to build your financial future.

Tweet