On average, Canadians still can’t get pass a financial literacy test with national average quiz score of 44%

In a new survey from Zolo, one of Canada’s largest online real estate markets, almost 1,400 respondents from across the country were tested on their financial knowledge, confidence and skills.

Despite a year of health concerns and financial constraints, Canadians were more confident in their money management skills—with 90% reporting “very good” or “good” confidence (up from 70% the year before).

Among the 2021 results:

- 90% felt confident about their overall financial knowledge

- 70% report they are good at keeping track of money

- 66% report they are good at making ends meet

- 83% believe they have a clear idea of what financial products they need

Failing Grade

Despite our high confidence in money matters, we still have a lot to learn. Overall, Canadians failed the financial literacy test with an average score of 44%.

There were regional differences. The highest quiz score came out of BC, at 82%, while the lowest was recorded in the Maritimes, at 4%.

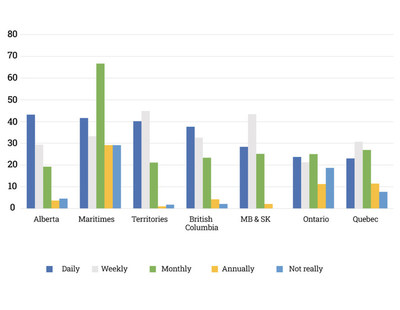

The survey on financial literacy provides insight into the areas where we were most confident and knowledgeable, along with areas where more education is required.

For instance, only 3% of respondents correctly defined a credit card, and only 6% of respondents knew that conventional fixed-rate mortgages are charged interest semi-annually in Canada. However, 91% of respondents correctly identified the behaviours that would hurt your credit rating and another 88% understood the importance of a household budget.

Impact of Financial Constraints

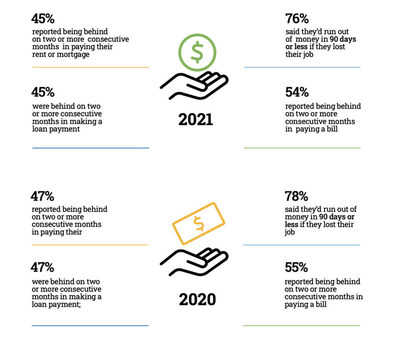

Survey results also highlighted the sustained financial difficulty Canadians experienced over the last year. According to survey results:

- 76% said they’d run out of money in 90 days or less, if they lost their job today

- 45% reported being behind on 2 or more consecutive months in paying their rent or mortgage

- 78% reported worrying about money on a daily, weekly or monthly basis

Tracking financial confidence, knowledge, and the application of money management skills is essential. Poor money management can lead to severe budget crunches and current and future lifestyle consequences.

For more information on Zolo’s findings, click here.

Tweet