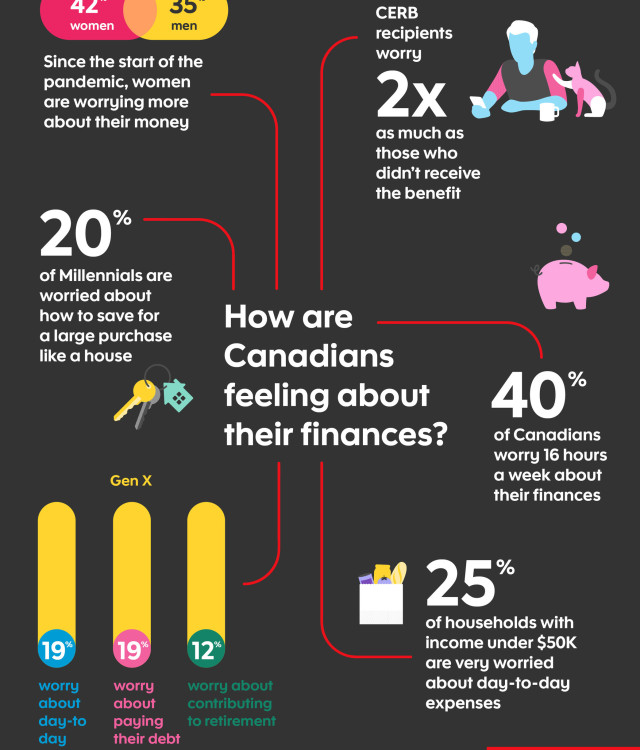

Nearly 40% of Canadians are worrying more about their finances since COVID-19 began, spending an average of 16 hours a week worrying. Meanwhile, 28% of Canadians say that they do not spend any time worrying about their finances. Millennials age 18-34 (45%) are worrying more about their financial health since the start of the COVID-19 […]