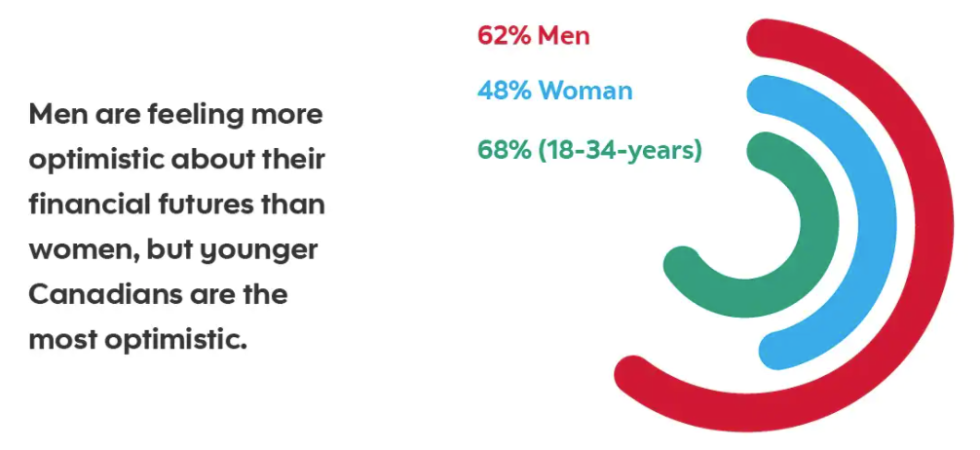

Consumers across Canada are preparing to hunker down for a long financial squeeze, amid growing financial concerns (80%) and low economic confidence (63%), according to the latest EY Future Consumer Index Survey. Over half of households expect their living costs to continue trekking upwards, as concerns over personal finances affect all income levels, from low income (87%) and […]