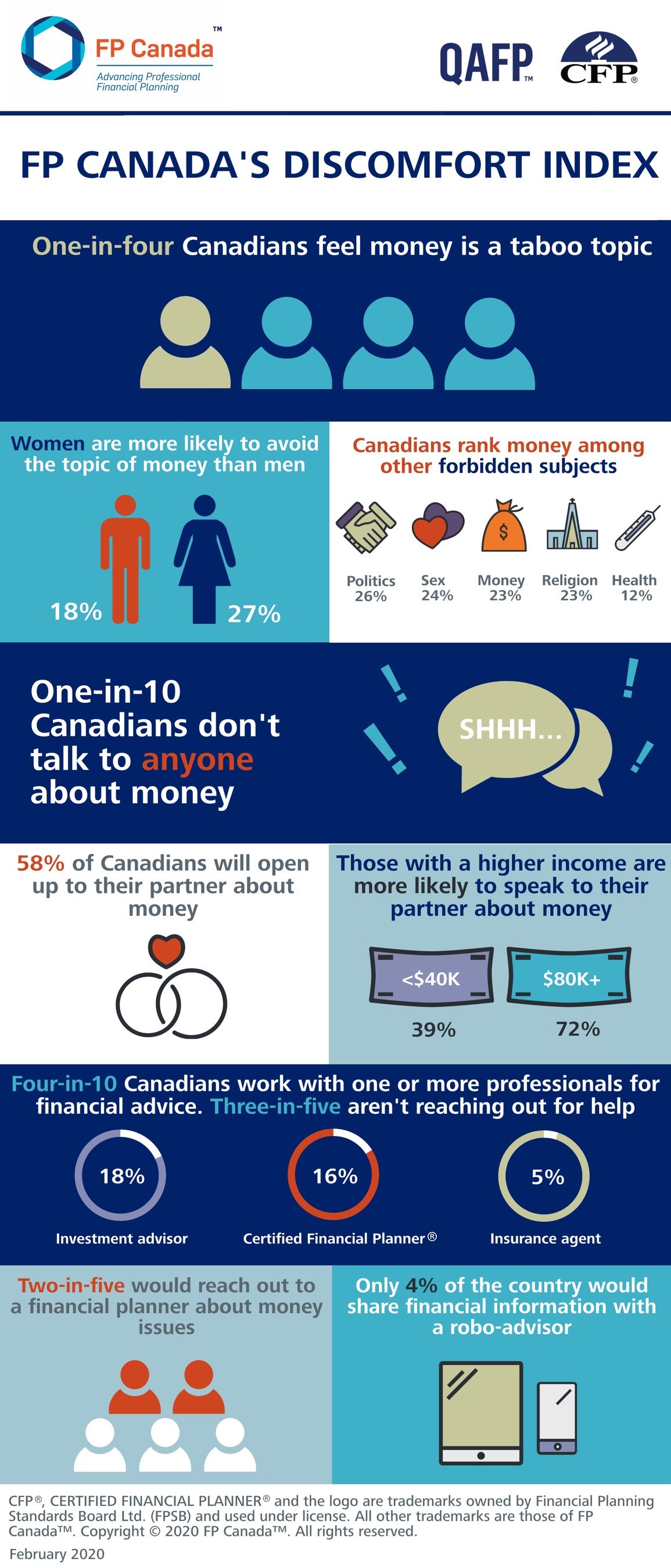

The saying goes, never discuss politics, sex or religion, but what about money? A new national survey by FP Canada™ finds that nearly one-in-four Canadians feel money is a taboo topic – ranking it alongside those other time-honoured, forbidden subjects.

The Discomfort Index, a Leger poll of 1,526 Canadians, asked people to rank their level of comfort/discomfort when discussing a series of issues. Interestingly, the top four topics were virtually tied in terms of their status as taboo. One-in-four Canadians (26%) said talking about politics makes them squirm the most, quickly followed by relationship/sex talk (24%), and money and religion (both 23%). Canadians were most comfortable talking about their health issues (with a taboo rating of just 12%).

Despite an increasing number of women managing family budgets, they are still more likely to avoid the topic of money (27%) than men (18%). Here are some other standout findings by gender:

- One-in-three women (33%) are uncomfortable talking about politics – versus only 19 percent of men

- More than a quarter of women (26%) find religion awkward – compared to 20 percent of men

- One quarter (25%) of both men and women eschew relationship/sex talk

- Men and women find equal discomfort in discussing health issues (12%)

Talk Money to Me

Eventually braving the ‘money talk’, the survey also probed Canadians on whom exactly they’d most likely discuss their finances with. Strikingly, one-in-ten (9%) don’t talk with anyone about money – a figure that stretches to 16 percent for those who earn $40K or less.

Meanwhile, 58 percent speak with their spouse/partner about money matters. Income levels again impact the conversation; 39 percent of those who earn $40K or less will talk to their spouse/partner compared to 72 percent of Canadians earning $80K or more.

Other listening ears include friends (44%), parents (31%), siblings/other family member (28%), adult children (20%), and work colleagues (19%). Finally, the outliers – a handful of Canadians dare to open-up their ‘books’ to strangers (3%), hairstylists and estheticians (2%).

Reaching out for help

Four-in-ten (38%) Canadians say they work with one or more specialists for financial advice, including an investment advisor (18%), a Certified Financial Planner® professional (16%) and insurance agent (5%). Those aged 55 or older are significantly more likely to work with some sort of financial expert compared to those aged 18-54. Higher earning Canadians ($80K+) are also much more likely to work with a financial expert compared to those earning less.

People prefer to open up to professional financial planners as opposed to robots

When it comes to opening up about money issues with someone else, 43 percent of respondents would speak with a financial planner, followed by a close friend (35%), family member (32%), investment advisor (30%), and accountant (25%). These categories all dwarfed online services such as robo-advisors (4%). The strong ranking of financial planners in this area shows that Canadians feel they can trust planners when it comes to discussing sensitive money-related concerns.

“The need for personalized financial planning advice from a human professional has never been greater,” said Keehn. “The bottom line is that technology simply can’t replace a professional financial planner whose knowledge is founded on a personal connection with clients, as well as a deep understanding of their entire financial picture.”

The full results of The Discomfort Index can be found here.